Inflation hedging strategies trends you should know

Inflation hedging strategies involve diversifying investments across assets like real estate, commodities, and inflation-linked securities to protect against rising prices and maintain purchasing power.

Inflation hedging strategies trends are becoming increasingly important as inflation rates fluctuate. Have you ever wondered how to shield your investments during uncertain economic times? This article will explore various strategies to help you stay ahead.

Understanding inflation and its impact

Understanding inflation is crucial for anyone interested in inflation hedging strategies. When prices rise over time, the purchasing power of money decreases. This can significantly affect savings and investments, making it essential to know how inflation works.

Inflation impacts various aspects of the economy, including consumer spending, interest rates, and asset values. As inflation rises, consumers might have to adjust their budgets, leading to decreased spending. This scenario can create ripple effects throughout the economy.

The causes of inflation

Several factors can cause inflation, including increased demand, rising production costs, and expansionary monetary policies. Understanding these causes is key to developing effective hedging strategies.

- Demand-pull inflation: Occurs when demand for goods and services exceeds supply.

- Cost-push inflation: Happens when rising costs of production lead to increased prices.

- Built-in inflation: Results from adaptive expectations where businesses increase wages and prices to match past inflation.

Recognizing how these factors contribute to inflation can help you make informed investment decisions. As inflation continues to affect financial markets, finding ways to protect your assets becomes increasingly important.

Inflation’s effects on investments

Inflation can erode the real returns on investments, causing concern for investors. For stock market investors, high inflation can lead to increased volatility. Conversely, assets like real estate or commodities often outperform during inflationary periods.

For those looking to safeguard their investments, adopting inflation hedging strategies promotes long-term financial health. These strategies can include diversifying into assets that typically benefit from inflation or adjusting portfolios to mitigate risks.

In conclusion, understanding inflation and its impact on the economy and investments allows for better decision-making. As you consider various inflation hedging strategies, remember the key factors driving inflation and how they influence your financial landscape.

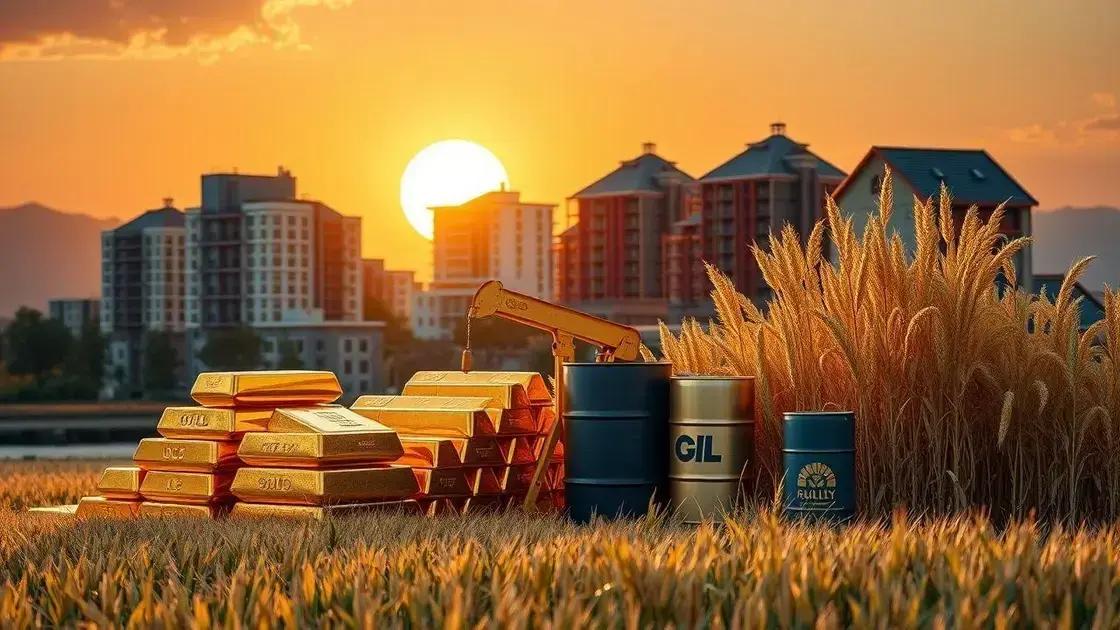

Top inflation hedging assets

When it comes to inflation hedging strategies, knowing the top assets to invest in is essential. Certain assets tend to retain value or grow even when inflation rises. Let’s explore some of these key assets.

Real Estate

Investing in real estate is often considered a strong hedge against inflation. Property values and rental incomes typically rise with inflation, allowing investors to maintain their purchasing power. Whether you buy residential, commercial, or industrial property, real estate can provide a reliable return.

- Potential for value appreciation

- Income generation through rent

- Tax benefits and deductions

In addition to its value retention, real estate can also diversify your investment portfolio, reducing overall risk.

Commodities

Another popular choice for hedging against inflation is commodities. Things like gold, silver, and agricultural products usually see price increases during inflationary periods. Investors often turn to commodities as a safe haven for their wealth.

- Gold: Often viewed as a store of value during economic uncertainty.

- Oil: Vital for global economies; its price usually rises with inflation.

- Food staples: Price increases in basic food products can indicate inflation.

Investing in commodities allows you to capture price swings and protect your investments during economic fluctuations. These tangible assets can be a reliable hedge against rising costs.

Inflation-linked Bonds

Inflation-linked bonds, such as Treasury Inflation-Protected Securities (TIPS), offer a unique investment option that adjusts with inflation. The principal increases with inflation, ensuring that your return keeps pace with rising prices.

This type of investment provides a steady income stream while preserving purchasing power. It’s ideal for those seeking security in uncertain economic times.

As inflation concerns continue, understanding the top inflation hedging assets is vital for safeguarding your financial future. Each asset offers unique benefits and can play a role in a well-rounded investment strategy.

Emerging trends in hedging strategies

Understanding emerging trends in hedging strategies is vital for investors looking to stay ahead. As the economy changes, so do the strategies that help protect investments from inflation and market volatility. Keeping an eye on these trends can lead to better decision-making.

Digital Assets

One significant trend is the rise of digital assets like cryptocurrencies. Many investors are exploring cryptocurrencies as a hedge against inflation. These assets, though volatile, can provide a unique layer of protection and diversification to an investment portfolio.

- Decentralization: Digital currencies offer a way to avoid traditional banking systems.

- Potential for high returns: Cryptocurrencies can yield significant profits during bull markets.

- Inflation resistance: Some coins are designed to limit supply, countering inflationary pressures.

As technology continues to evolve, digital assets are becoming an essential consideration for those looking to hedge against financial uncertainty.

Environmental, Social, and Governance (ESG) Investments

ESG investments are gaining popularity as more investors focus on sustainable practices. The demand for responsible investing is pushing the financial market to adapt. Companies with strong ESG performances tend to be more resilient during economic downturns, making them appealing for hedging.

Investing in businesses that prioritize sustainability and ethical practices can lead to long-term growth and stability. Many investors believe that companies with strong ESG practices are better equipped to navigate regulatory changes and increase consumer trust.

Alternative Investment Strategies

Alternative investments, such as private equity and hedge funds, are on the rise. These strategies often focus on non-traditional assets and markets. They provide ways to manage risk that differ from more conventional approaches.

Investors are increasingly looking towards alternatives to help mitigate risks associated with inflation and market instability. By diversifying into these areas, investors can enhance their overall portfolio performance.

As you explore these emerging trends in hedging strategies, keep in mind that adaptability and awareness are crucial. Adjusting your investment approach based on current trends can provide significant advantages in a changing economic landscape.

Practical tips for hedging against inflation

When it comes to practical tips for hedging against inflation, there are several strategies that can help protect your investments. Understanding how to implement these tips can make a significant difference in maintaining your financial health.

Diversify Your Portfolio

Diversification is a key strategy in investing. By allocating your funds across various asset classes, you can reduce risk and improve your chances of maintaining gains during inflationary periods.

- Stocks: Consider adding equities with strong fundamentals that tend to perform well during inflation.

- Bonds: Look for inflation-protected securities like TIPS, which adjust with rising prices.

- Real Estate: Investing in property can provide rental income and appreciation, helping to counteract inflation.

By diversifying, you allow different parts of your portfolio to react separately to changes in the economy, helping to mitigate overall risk.

Invest in Commodities

Another effective method is to include commodities in your investment strategy. Commodities like gold, silver, oil, and agricultural products often see price increases during inflation.

Investing in these can provide a hedge as they tend to retain value. You can invest directly in physical commodities or through ETFs that focus on these asset classes.

Consider Inflation-linked Investments

Inflation-linked investments, such as Treasury Inflation-Protected Securities (TIPS), are designed to help protect against rising prices. The principal value of TIPS increases with inflation, providing an adjustable return that helps preserve purchasing power.

By adding these to your portfolio, you not only secure stable returns during inflation but also enjoy tax advantages.

Keep Cash Reserves

Having a cash reserve can also be a practical way to hedge against inflation. While cash doesn’t grow much in value, it provides liquidity. In times of high inflation, having cash allows you to take advantage of buying opportunities without the need to sell other assets at a loss.

As you implement these practical tips for hedging against inflation, remember that each strategy has its advantages and risks. Staying informed and flexible will help you adapt to changing market conditions while protecting your investments.

FAQ – Frequently Asked Questions about Inflation Hedging Strategies

What is inflation hedging?

Inflation hedging is an investment strategy used to protect the purchasing power of assets against rising inflation.

How can I diversify my portfolio to hedge against inflation?

You can diversify by investing in a mix of stocks, bonds, real estate, and commodities that tend to retain value during inflation.

Are cryptocurrencies a good option for inflation hedging?

Cryptocurrencies can offer a hedge against inflation, but they are volatile and should be approached with caution as part of a diversified strategy.

What role do TIPS play in hedging against inflation?

Treasury Inflation-Protected Securities (TIPS) are designed to increase in value with inflation, providing a reliable return that helps maintain purchasing power.